○夢んぼ本部

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-25-5913

Fax:0567-55-8120

○第2夢んぼ

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-28-1070

Fax:0567-28-1070

○ソーシャルセンター夢んぼ

〒490-1304

住所:稲沢市平和町法立十一丁31番地4

Tel:0567-69-5586

Fax:0567-69-5587

○ワークステーション夢んぼ

第2ワークステーション夢んぼ

〒496-8014

住所:愛西市町方町松川70番地1

Tel:0567-55-7456

Fax:0567-55-7458

○ライフステーション夢んぼ

〒496-8014

住所:愛西市町方町大山田62番1

Tel:0567-31-7811

Fax:0567-31-9171

○ハビリテーションセンター夢んぼ

〒496-8014

住所:愛西市町方町大山田86番地

Tel:0567-69-4448

Fax:0567-69-4446

○青空ヘルパーステーション

〒474 0035

住所:大府市江端町二丁目80番地2F

Tel:0562-74-8883

Fax:0562-74-8884

Content

We need to perform a horizontal analysis of the income statement of this company. Different financial documents will have different relevant base figures. Vertical analysis serves as a more feasible technique compared to horizontal analysis. It is also useful for inter-firm or inter-departmental performance comparisons as one can see relative proportions of account balances, regardless of the size of the business or department. With vertical analysis, changes are strictly represented by percentages. It means the changes are shown as a percentage of a base item in the statement and there are no representations for variance.

Example of Horizontal Analysis

Horizontal analysis typically shows the changes from the base period in dollar and percentage. For example, a statement that says revenues have increased by 10% this past quarter is based on horizontal analysis.

Horizontal analysis, or trend analysis, is a method where financial statements are compared to reveal financial performance over a specific period of time. Use it to spot trends in your business.Horizontal horizontal analysis formula analysis, also known as trend analysis, is used to spot financial trends over a specific number of accounting periods. Horizontal analysis can be used with an income statement or a balance sheet.

The 50% still represents a positive outcome from 2018 even though it still represents an overall decline in the growth of revenue. Impact your business’s activities have on your business’s financial well-being, regardless of your business’s size. Horizontal analysis also makes it easier to detect when a business is underperforming.

You will see such examples in the calculation of return on assets and return on equity later. There’s a reason horizontal analysis is often referred to as trend analysis. Looking at and comparing the financial performance of your business from period to period can help you spot positive trends, such as an increase in sales, as well as red flags that need to be addressed. As a result, some companies maneuver the growth and profitability trends reported in their financial horizontal analysis report using a combination of methods to break down business segments. Regardless, accounting changes and one-off events can be used to correct such an anomaly and enhance horizontal analysis accuracy. Investors can use horizontal analysis to determine the trends in a company’s financial position and performance over time to determine whether they want to invest in that company. However, investors should combine horizontal analysis with vertical analysis and other techniques to get a true picture of a company’s financial health and trajectory.

The percentages reflects the changes that have occurred over successive periods. With horizontal analysis, you use a line-by-line comparison to the totals. For instance, if you run a comparative income statement for 2019 and 2020, horizontal analysis allows you to compare the revenue totals for both years to see if it increased or decreased, or remained relatively stable. If possible, you should aim to add 2018 to the mix, so you’ll be able to see if it was a trend or just a fluke. If the two numbers are from the same statement (e.g. both from the income statement and both from the balance sheet), you just need to divide the two numbers.

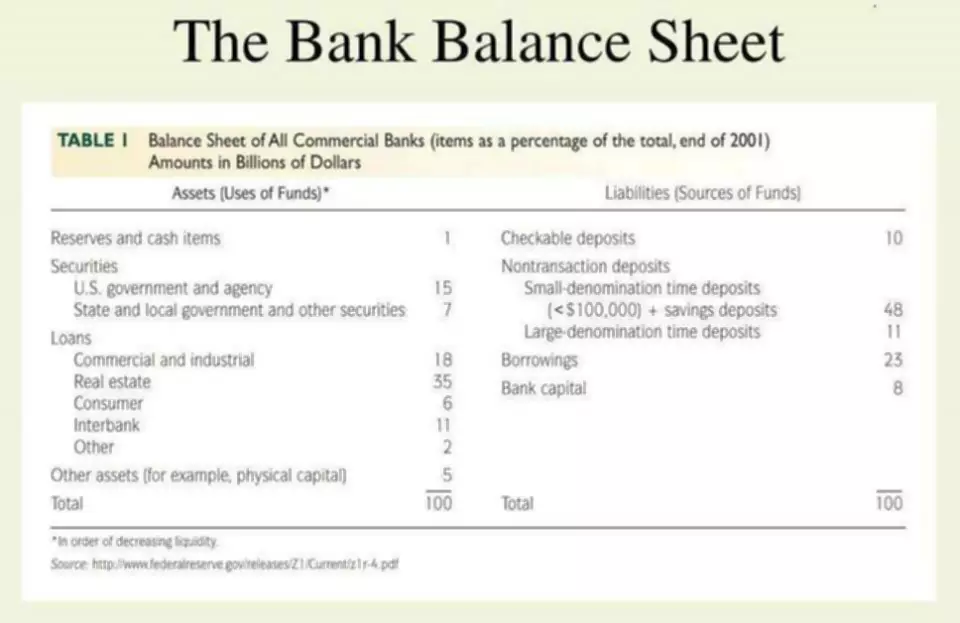

This analysis lets you see how effectively you’re leveraging the cash in your business, beyond just dollars flowing into and out of your bank account. Common size balance sheets are similar to common size income statements. The only difference is that each line item on this accounting balance sheet is expressed as a percentage of total assets. The term “horizontal analysis” refers to the practice of comparing and contrasting financial data across multiple periods. It’s a valuable indicator of a company’s growth and financial standing compared to rivals.

Calculate the absolute change by deducting amount of base year from the amount of comparing year. Let us understand this analysis with the help of the following balance sheet. Whether you perform this analysis every fiscal year or every quarter, the information it provides is well worth the time and effort required.

Better yet, you can see many years of balance sheets and income statements and make a comparison among them. As it is majorly carried out on a single time period, Vertical analysis is also known as static analysis. Results from vertical analysis over multiple financial https://www.bookstime.com/ periods can be particularly useful while conducting regression analysis. Accountants see relative changes in company accounts over a given period of time and determine the best strategy to improve the relationship between financial items and variables.