○夢んぼ本部

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-25-5913

Fax:0567-55-8120

○第2夢んぼ

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-28-1070

Fax:0567-28-1070

○ソーシャルセンター夢んぼ

〒490-1304

住所:稲沢市平和町法立十一丁31番地4

Tel:0567-69-5586

Fax:0567-69-5587

○ワークステーション夢んぼ

第2ワークステーション夢んぼ

〒496-8014

住所:愛西市町方町松川70番地1

Tel:0567-55-7456

Fax:0567-55-7458

○ライフステーション夢んぼ

〒496-8014

住所:愛西市町方町大山田62番1

Tel:0567-31-7811

Fax:0567-31-9171

○ハビリテーションセンター夢んぼ

〒496-8014

住所:愛西市町方町大山田86番地

Tel:0567-69-4448

Fax:0567-69-4446

○青空ヘルパーステーション

〒474 0035

住所:大府市江端町二丁目80番地2F

Tel:0562-74-8883

Fax:0562-74-8884

Contents

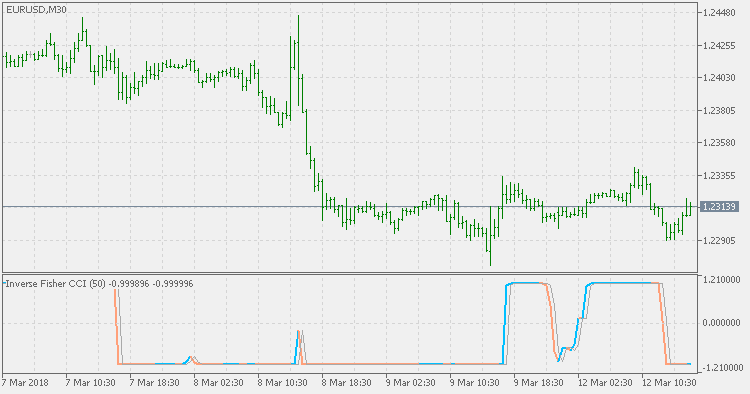

It should not be too wide because you will miss a lot of signals that could make you money. Here you can go short with a stop above the most recent high. You can trail the position using trendlines or price action. In all the three instances price fell 5.6%, 3.6% and 7.6% from the short term market tops when the indicator dipped below 2%. In the second scenario, the low bandwidth reading called the short-term top and subsequent price selloff.

BB Width is one of the most accurate tool to measure volatility. The chart below is of American Express from the start of 2008. In a couple of instances, the price action cut through the centerline , but for many traders, this was certainly not a buy signal as the trend wasn’t broken. A trader can visually identify a squeeze when the upper and lower bands get closer together, constricting the moving average. A squeeze is a sign of decreased volatility and is considered by investors as a possible sign of future increased volatility and potential trading opportunities. Conversely, the further away the bands move from each other, the more likely the chance of a decline in volatility and the more significant the possibility of exiting a trade.

Then look no further than the Bollinger band and the RSI combination. Divergences are powerful indicators that can signal either a correction or a trend change. They are easy to spot in hindsight but trading them in real time can be quite a challenge. In many cases though, the indicators that are used in a trading strategy along with a Bollinger band tend to be redundant. The basic idea behind using two or more indicators in a trading strategy is to get different views of the market. Envelope channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands.

Bollinger Bands cannot be used as a standalone trading method. They are merely one indicator designed to provide traders with data regarding price volatility. John Bollinger suggests using them in conjunction with other non-correlated indicators that provide more direct market signals. Bollinger Bands are a relatively simple trading tool and are incredibly popular with professional as well as at-home traders. However, using only the bands to trade is a risky strategy since the indicator focuses on price and volatility while ignoring various other relevant information.

Please note, at the core of the MACD system, are moving averages. Hence the MACD indicator has similar properties like that of a moving average system. They work quite well when there is a strong trend and are not too useful when moving sideways.

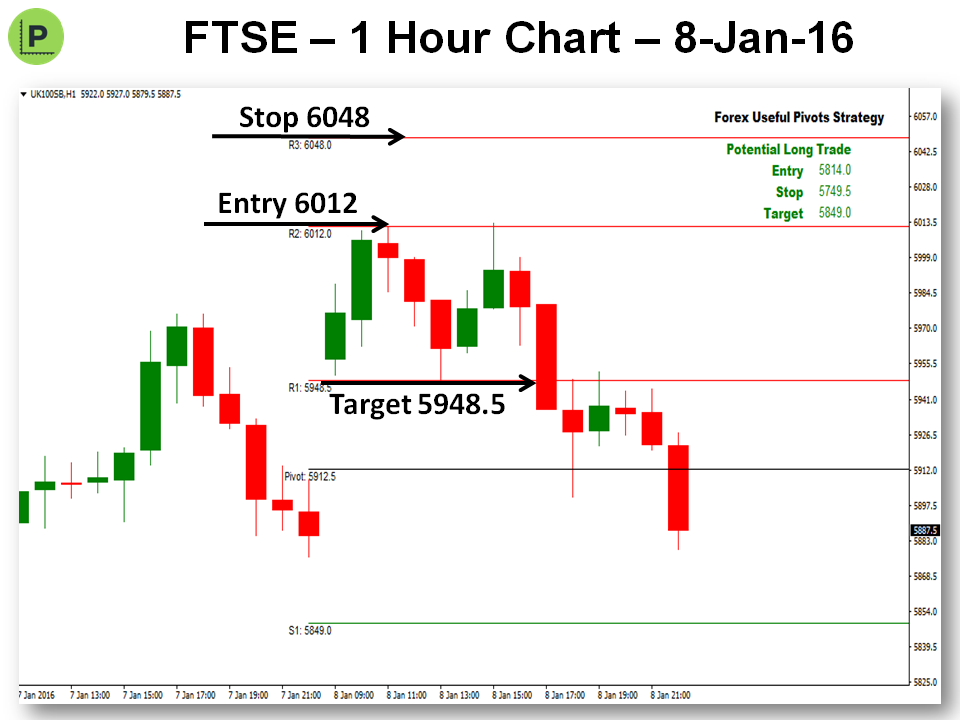

If it does, that’s a possible indication of a reversal or that the stock is losing strength. A breakout to the upside signals traders to initiate long positions or exit short positions. Conversely, a breakout to the downside signals traders to open short positions or exit long positions. A stop-loss order is traditionally placed outside the consolidation on the opposite side of the breakout. Another popular strategy to use with Bollinger Bands is called a squeeze strategy.

Bollinger bands aged over 4 decades and are still very useful. While reading this, you will learn about John Bolinger, how he discovered his band concept and its application to trading. The first N-1 periods will have null values since there’s not enough data to calculate. Not regularly, but you need to understand what levels work for which stock. For example a level of 40 and 60 may work extremely well for Infy while at the same time 30 and 70 may work for TCS. No in fact what you can do is estimate the level upto which the RSI increases and based on this you can re calibrate the oversold and overbought levels.

Chart 4 shows Exxon Mobil with an M-Top in April-May 2008. The stock moved above the upper band in April, followed by a pullback in May and another push above 90. Even though the stock moved above the upper band on an intraday basis, it did not CLOSE above the upper band. The M-Top was confirmed with a support break two weeks later.

Importantly, however, these conditions should not be taken as trading signals. The bands give no signs of when the change may take place or in rights and duties of buyer which direction the price might move. According to Bollinger, it is necessary to look to other indicators to determine breakout direction.

Bollinger Bands are often used to identify M-Tops and W-Bottoms or to determine the strength of the trend. Traders designate the upper and lower bands as price targets when drawing the bands. Since there has been some demand for the QQE figured I should upload my modified version of it as well. The Orginal script is from Glaz, this is not my original idea – all I did was pretty much smash two QQEs together.

Furthermore, the usage of a 20-day simple moving average and two standard deviations is rather discretionary and may not be appropriate for all traders in all situations. Traders should make necessary adjustments to their SMA and standard deviation assumptions and keep track of them. A stock may trade for long periods in a trend, albeit with some volatility from time to time.

Implied volatility is a measure that helps traders to understand the chances of changes in the prices of a given… Price can go beyond a band envelope for long periods when there are strong trends. On divergence with a momentum oscillator, always carry out more research to know if taking additional profits is right for you. A strong trend can be expected to continue as the price moves out of the bands. Price can pierce the band envelope for long periods of time during strong trends.

It involves the use of three bands—one for the upper level, another for the lower level, and the third for the moving average. When prices move closer to the upper https://1investing.in/ band, it indicates that the market may be overbought. Conversely, the market may be oversold when prices end up moving closer to the lower or bottom band.

The first step in calculating Bollinger Bands® is to compute the simple moving average of the security in question, typically using a 20-day SMA. A 20-day moving average would average out theclosing pricesfor the first 20 days as the first data point. The next data point would drop the earliest price, add the price on day 21 and take the average, and so on.

However, it is not predictive of trend direction, and its sole focus on price and volatility and avoiding other relevant information makes it a risky strategy. Hence it is appropriate to use in combination with other technical analysis indicators. Bollinger Bands are a widely popular technical analysis instrument created by John Bollinger in the early 1980’s. Bollinger Bands consist of a band of three lines which are plotted in relation to security prices.

If the selected band settings fail to work, traders may alter the settings or use a different tool altogether. In range-bound markets, mean inversion techniques can function as price travel between the two bands. In any case, Bollinger bands don’t necessarily give precise trade signals. During a solid trend, for instance, the trader risks putting exchanges on some unacceptable side of the move if the pointer can streak overbought or oversold flags too early. While every strategy has its drawbacks, Bollinger Bands® are among the most useful and commonly used tools in spotlighting extreme short-term security prices. One of the main limitations is that it shouldn’t be used as a standalone tool.

Thanking you won’t be sufficient to express my gratitude to you for writing such a wonderful tutorial. But I do not treat the indicators with the same conviction. It is always good to know what indicators convey, but I don’t base my decisions. If the indicators confirm, I increase the bet size; if they don’t, I still go ahead with my original game plan.

For instance, if the trend is down, possibly take short positions when the upper band is labeled. The lower band can, in any case, be utilized as an exit; however, another long position isn’t opened since that would mean conflicting with the trend. A typical methodology while utilizing Bollinger bands is recognizing overbought or oversold economic situations.

As the cost exchanges nearer to the bands, the chance becomes more noteworthy that the market is overbought or oversold . Most traders intend to benefit from areas of strength for reversal happens. When a stock does not arrive at other peaks, traders often monitor the asset to reduce a switch trend’s misfortunes. Traders screen the uptrend to know when it shows strength or weakness, and they utilize this as a sign of a potential trend reversal.

A standard MACD is calculated using a 12 day EMA and a 26 day EMA. Please note, both the EMA’s are based on the closing prices. We subtract the 26 EMA from the 12 day EMA, to estimate the convergence and divergence value.

The bands widen when there is a price increase, and narrow when there is a price decrease. Due to their dynamic nature, Bollinger Bands can be applied to the trading of various securities. Bollinger Bands can be found in SharpCharts as a price overlay. As with a simple moving average, Bollinger Bands should be shown on top of a price plot.

You said it, the best way to learn TA is by keeping it really simple and not complicating it with many lines and indicators. In the previous chapters, we started building a checklist that acts as a guiding force behind the trader’s decision to buy or sell. The chart’s vertical lines highlight the chart’s crossover points where a signal to buy or sell originated. When the MACD is negative, it means the 12 day EMA is lower than the 26 day EMA.