○夢んぼ本部

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-25-5913

Fax:0567-55-8120

○第2夢んぼ

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-28-1070

Fax:0567-28-1070

○ソーシャルセンター夢んぼ

〒490-1304

住所:稲沢市平和町法立十一丁31番地4

Tel:0567-69-5586

Fax:0567-69-5587

○ワークステーション夢んぼ

第2ワークステーション夢んぼ

〒496-8014

住所:愛西市町方町松川70番地1

Tel:0567-55-7456

Fax:0567-55-7458

○ライフステーション夢んぼ

〒496-8014

住所:愛西市町方町大山田62番1

Tel:0567-31-7811

Fax:0567-31-9171

○ハビリテーションセンター夢んぼ

〒496-8014

住所:愛西市町方町大山田86番地

Tel:0567-69-4448

Fax:0567-69-4446

○青空ヘルパーステーション

〒474 0035

住所:大府市江端町二丁目80番地2F

Tel:0562-74-8883

Fax:0562-74-8884

Content

The left side of the accounting equation includes all the asset accounts and the right side contains all the liability and equity accounts. To increase an asset account, remember that the assets are on the left side of the fundamental equation, and so you record a debit entry on the left side of the “T”. To increase an equity or liability account, remember that these accounts are located on the right side of the fundamental equation, and so you record a credit entry on the right side of the “T”. There are no exceptions to this rule, even though some accounts may seem to have strange rules at first. These withdrawals are recorded as debits, because they decrease equity. An accounting system tracks the financial activities of a specific asset, liability, equity, revenue or expense.

Accounting For Beginners: What is General Ledger Accounting?.

Posted: Fri, 25 Nov 2022 20:25:03 GMT [source]

Although the accounting system you choose will be unique to your business and its industry, business owners are likely to encounter some common situations. https://www.bookstime.com/ accountswere formally invented in the 15th century by Luca Pacioli, as an official system to specify what was already used by merchants in Venice. They used this system in the Middle East, Florence, and the Mediici bank. Accounting Game – Debits and Credits is designed to challenge and teach common accounting transactions in a visually entertaining and engaging way. To practice T-account transactions, download Accounting Game – Debits and Credits, the free Apple App. A common way that accountants often use to remember whether to credit or debit an account is using DC ADE LER.

In accounting terms, however, if a transaction causes a company’s checking account to be credited, its balance decreases. Moreover, crediting another company account such as accounts payable will increase its balance. Without further explanation, it is no wonder that there often is confusion between debits and credits.

The process of using debits and credits creates a ledger format that resembles the letter “T”. The term “T-account” is accounting jargon for a “ledger account” and is often used when discussing bookkeeping. The reason that a ledger account is often referred to as a T-account is due to the way the account is physically drawn on paper (representing a “T”).

Examples include money paid for the loss of a lawsuit and a loss in value from the sale of an asset or business property. Recording what happens to each of these buckets using full English sentences would be tedious, so we need a shorthand. The rules governing the use of debits and credits are noted below. DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. If you want to learn accounting, debit and credit would be the first concepts you would learn. Even in smaller businesses and sole proprietorships, transactions are rarely as simple as shown above.

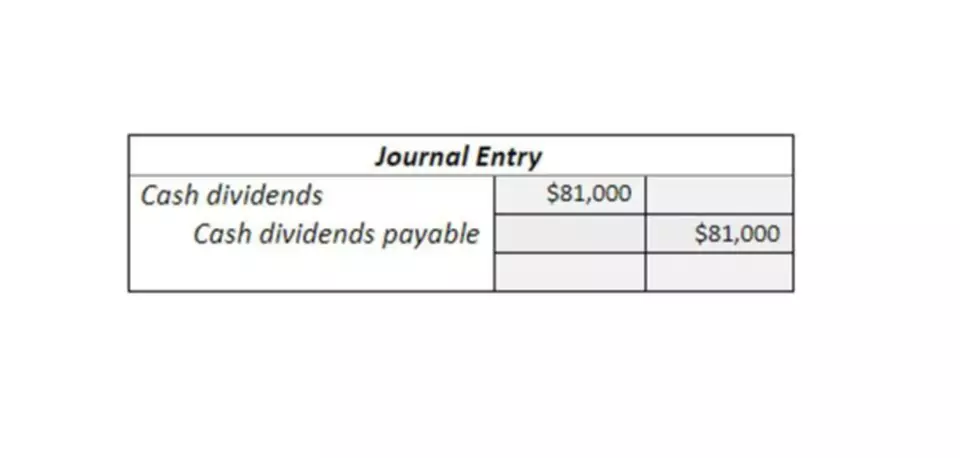

In the below example of a journal entry, a business owner paid their employee’s salary. Cash was used to pay the salary, so the asset decreases on the credit side , and salary expenses increase on the debit side .

These include things like property, plant, equipment, and holdings of long-term bonds. With regards to expense accounts, debits increase the balance of the account while credits decrease the balance. So, if you have an expense account with a balance of $1,000 and you make a purchase for $100, the new balance of the account would be $1,100 (a debit of $100 increased the balance by $100). Equity accounts are records of a company’s ownership stake, so they are affected by debits and credits in different ways. When a company receives money from shareholders, it is recorded as a credit to the equity account. The “rule of debits” says that all accounts that normally contain a debit balance will increase in amount when debited and reduce when credited.

All accounts also can be debited or credited depending on what transaction has taken place. Some balance sheet items have corresponding “contra” accounts, with negative balances, that offset them. Examples are accumulated depreciation against equipment, and allowance for bad debts against accounts receivable. For example, sales returns and allowance and sales discounts debits and credits are contra revenues with respect to sales, as the balance of each contra is the opposite of sales . To understand the actual value of sales, one must net the contras against sales, which gives rise to the term net sales . To determine whether to debit or credit a specific account, we use either the accounting equation approach , or the classical approach .