○夢んぼ本部

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-25-5913

Fax:0567-55-8120

○第2夢んぼ

〒496-8014

住所:愛西市町方町大山田61番1

Tel:0567-28-1070

Fax:0567-28-1070

○ソーシャルセンター夢んぼ

〒490-1304

住所:稲沢市平和町法立十一丁31番地4

Tel:0567-69-5586

Fax:0567-69-5587

○ワークステーション夢んぼ

第2ワークステーション夢んぼ

〒496-8014

住所:愛西市町方町松川70番地1

Tel:0567-55-7456

Fax:0567-55-7458

○ライフステーション夢んぼ

〒496-8014

住所:愛西市町方町大山田62番1

Tel:0567-31-7811

Fax:0567-31-9171

○ハビリテーションセンター夢んぼ

〒496-8014

住所:愛西市町方町大山田86番地

Tel:0567-69-4448

Fax:0567-69-4446

○青空ヘルパーステーション

〒474 0035

住所:大府市江端町二丁目80番地2F

Tel:0562-74-8883

Fax:0562-74-8884

Content

Without knowing how many employee hours they have available, a company may commit to more work than they can realistically complete, or they may underestimate their capacity and pay for more workers than they need. Add up all the employees’ FTE to determine the total Full-Time Equivalent of the company. The FTE definition refers to the number of hours of work of a full-time employee. 100% FTE or 1.0 FTE refers to one full-time employee or a number of people who make up the duties of one full-time position. To qualify for PPP loan forgiveness an organization must have maintained the same level of FTE employees during certain specified time periods following the loan disbursement. The amount they are liable to pay the IRS for an employer shared responsibility payment.

Two workers working 15 hours weekly would be considered part time and their combined FTE would be one. This definition is the most commonly used to determine how many FTE you have for ACA purposes. Both Carole and Lynn in our example above would be full-time employees under this example. The ACA makes health coverage a shared responsibility of individuals, employers, and the government to ensure that as many people as possible have affordable health insurance. While the law doesn’t require all business organizations to offer health insurance to their workers, employers who have 50 or more FTEs and are therefore considered ALEs must comply with the employer mandate. Thankfully, a business owner can easily confirm their ALE status.

Jennifer Hartman has more than 20 years of writing and content experience, working with small businesses and Fortune 100 companies. To determine this amount, ask yourself, what do you expect a full-time employee to work in terms of hours per week? Jennifer Hartman is an HR Specialist and staff writer for Fit Small Business, with over 15 years of experience in accounting, payroll, and human resources. The Full-Time Equivalent is the number of hours a business considers fte meaning a full-time employee to work. While each business may require a different number of hours, legally most employees are full-time at 30 hours a week. To do this, take the number of hours a full-time employee should work each week, and multiply by how many weeks per year the company expects the employee to work. To calculate the Full-Time Equivalent, simply divide the number of hours an employee works by the number of hours the company counts as full-time.

Private networks in numbers – surge or stasis? (Down a rabbit hole with a calculator).

Posted: Fri, 21 Oct 2022 16:02:40 GMT [source]

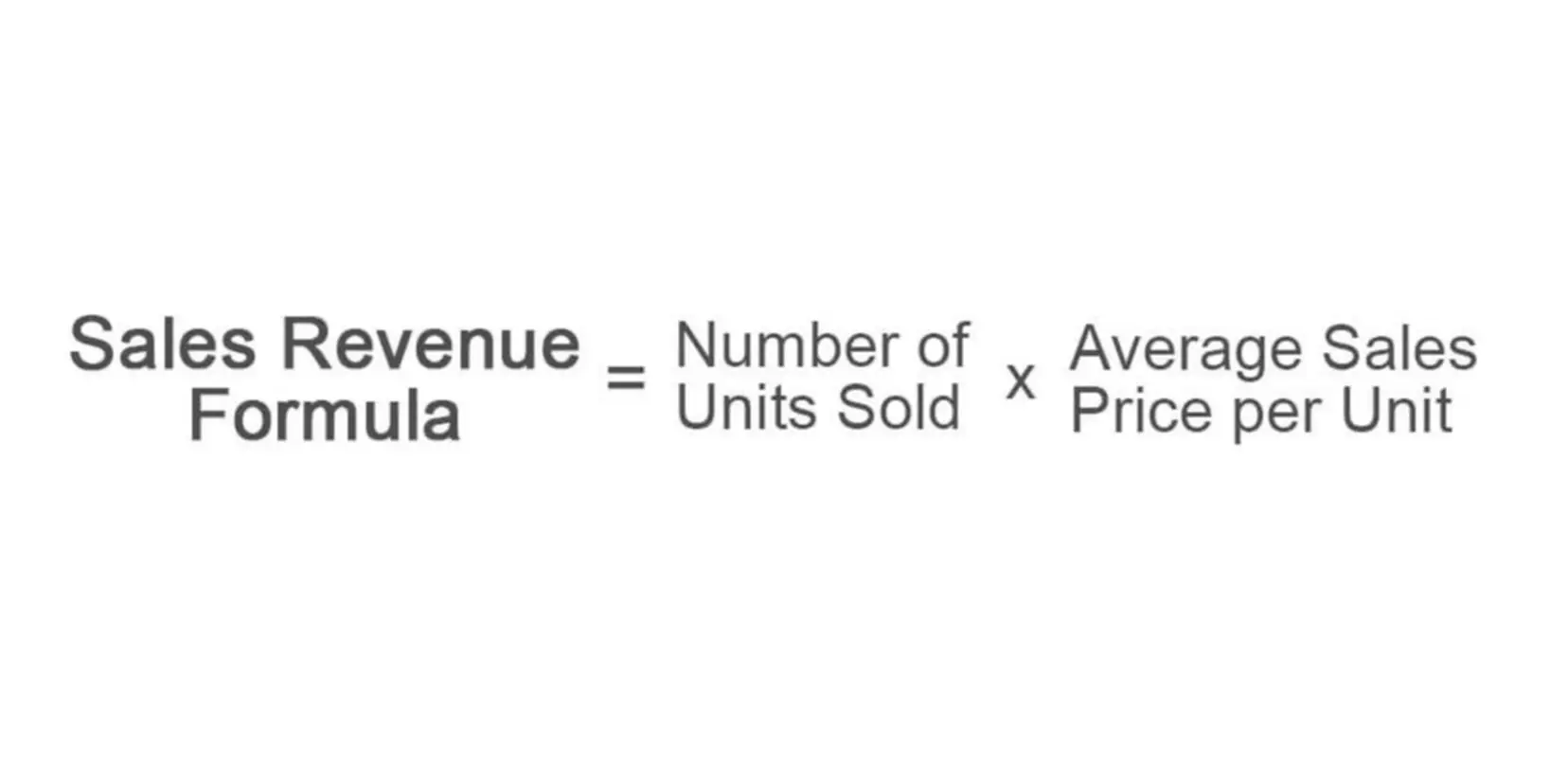

To convert time to military time, add 12 to the afternoon hours while keeping the same morning hours. In a recent conversation, Toggl Track’s CFO shared her process for determining whether or not the company is ready for a new hire. First, she calculates future cash flow when considering hiring/wage increases. https://www.bookstime.com/ Next, she uses this figure to estimate the company’s health (awesome, of course!) by comparing it to the amount Toggl Track needs to operate properly. By examining revenues instead of profits , you can judge profitability on an employee’s actual work, not your other costs (ad costs, etc.).

With more than a decade of accounting and finance experience, Charlette has worked side-by-side with HR and accounting leaders to establish and help implement payroll best practices, controls, and systems. Her experience ranges among small, mid-sized, and large businesses in industries like banking and marketing to manufacturing and nonprofit. Your 55 part-time and full-time employees are equal to 48.68 FTE.

These calculations are used to clarify the company’s obligations regarding employee health benefits. However, the IRS mandates only 30 hours per week or 130 hours per month for an employee in the US to be considered full-time in terms of the type of employment. Clockify lets you track your cost rates per employee and then compare and contrast them with employee billable hourly rates.

Full-time employees usually work 40 hours each week for over 120 days a year, but it also includes anyone who works more than 30 hours weekly. Add all of the hours from full-time workers together to use for your calculation. It is critical for accounting purposesand determining wages, and for calculating the company’s expenses when paying its workers. What’s important is that “on average” they work under 30 hours a week.

It helps determine the number of full-time and part-time employees for a task or project. To determine your total FTE, add the total part-time hours worked, plus the total full-time hours worked. From there, if your full-time hours are 40 per week, divide the number by 2,080. If your total full-time hours are 30 per week, divide the number by 1,560. This will give you your total FTE for all full- and part-time employees for the year.

Once you decide why you want to use FTE, identify the appropriate calculation method, and follow it through. To calculate the full-time equivalent for part-time employees, add up their work hours and divide that number by 120. The expected length of a full-time schedule has changed a lot through history — full-time employees now work about 20 or 30 hours per week less than they did in the 19th century. The 40-hour workweek calculation is applicable if you are doing the math for accounting and business purposes.